Satoshi’s Shadow: How the Bitcoin Mystery Shapes the Future of Business

- Sushovan Shrestha

- Reviewed by Jurgen & Sid

The HBO documentary “Money Electric: The Bitcoin Mystery” offers a captivating exploration of the origins and potential of cryptocurrencies.

While the film focuses on the enigmatic figure of Satoshi Nakamoto, it also raises crucial questions about the future of digital currencies and their impact on businesses.

In this blog post, we will analyze the themes presented in “Money Electric” and examine their implications on business.

Table of Contents

Understanding the Implications of Satoshi Nakamoto’s Identity

While the identity of Satoshi Nakamoto remains a mystery, the perception of this figure can significantly impact market sentiment.

As a business, it is undoubtedly essential to stay informed about market trends and be prepared for potential shifts.

The documentary concludes based on a few additional pieces of evidence as opposed to a 100% confirmation.

The documentary brings some new elements related to the identity of Satoshi Nakamoto, but does not present a 100% confirmation.

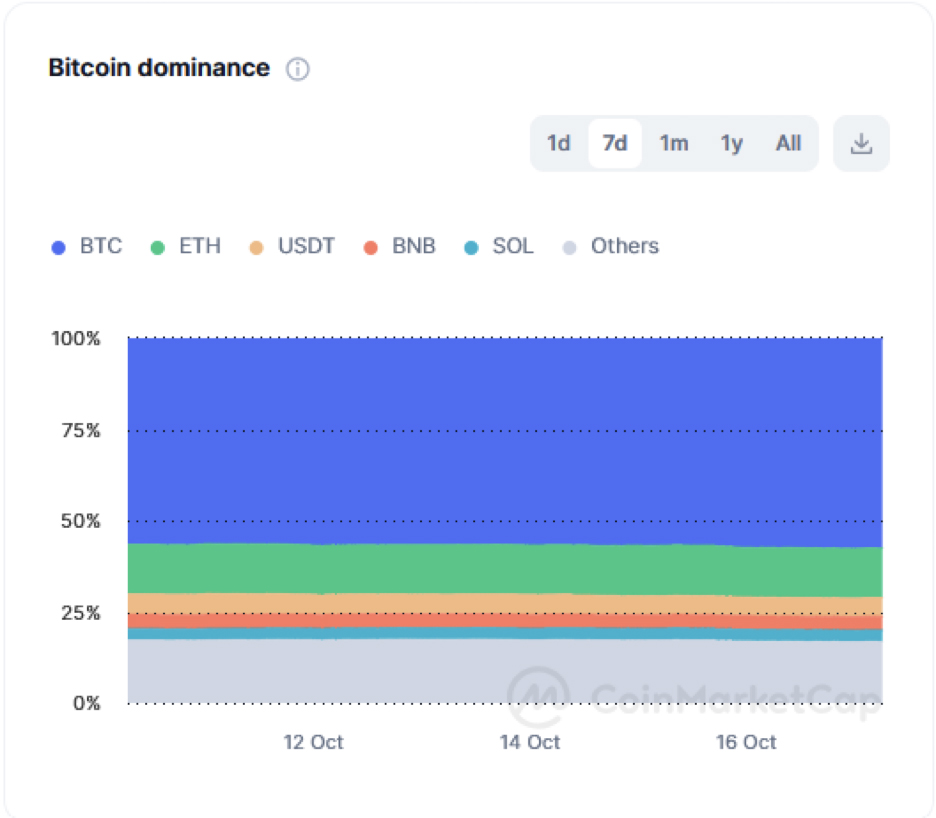

Ultimately, Money Electric doesn’t impact the crypto community significantly, as Bitcoin remains unfazed even after a week of the movie’s release.

Source: Coin Market Cap

Key Takeaways:

Market Sentiment: The perception of Satoshi Nakamoto can influence investor confidence and market volatility. However, his identity still remains a mystery.

Navigating Market Volatility

The cryptocurrency market is known for its volatility.

The continuous search for Nakamoto can always play a significant role in this volatility.

Hence, it is never a bad idea to have contingency plans in place to manage market fluctuations and protect your business interests.

Key Takeaways:

- Risk Management: Develop strategies to mitigate the risks associated with market volatility.

- Diversification: Consider diversifying your cryptocurrency holdings to reduce exposure to individual coin fluctuations.

- Hedging: Explore hedging techniques to protect your business against potential losses.

Staying Ahead of Regulatory Changes

Governments worldwide are constantly reevaluating their stance on cryptocurrencies.

These changes could either benefit or hinder businesses.

So, you need to be on your toes to make the best of the situation that heads your way.

Stay informed about the latest developments and be prepared to adjust your operations accordingly.

Key Takeaways:

- Regulatory Monitoring: Keep track of regulatory changes at both local and international levels.

- Compliance: Ensure your business operations align with all relevant regulations.

- Legal Counsel: Seek legal advice to navigate complex regulatory landscapes.

Building Consumer Trust

Countless factors influence consumer perceptions of businesses.

In fact, this PWC study states that 90% of business executives think customers highly trust their companies while only 30% of consumers actually do.

Therefore, investing in consumer education to foster a better understanding of digital currencies can help ease the audiences’ uncertainties.

Key Takeaways:

- Education: Provide educational resources to help customers understand the value and benefits of cryptocurrencies.

- Customer Support: Offer excellent customer support to address any questions or concerns related to cryptocurrency payments.

- Transparency: Maintain transparency in your business practices to build trust and credibility.

Rethinking Payment Systems

Despite the threat of Nakamoto’s million bitcoins, the cryptocurrency still remains at the top.

Nevertheless, promising competitors can hold ground even if bitcoin bites the dust.

Moreover, the number of central banks adopting digital currencies is also on the rise.

As a business, you’ll need to evaluate your payment systems regularly to ensure they align with evolving consumer preferences and the growing adoption of digital currencies.

Key Takeaways:

- Assessment: Evaluate your current payment systems to determine their suitability for cryptocurrency transactions.

- Integration: Consider integrating cryptocurrency payment options into your business.

- Customer Preferences: Understand your customers’ preferences and adapt your payment systems accordingly.

Investing in Team Education

We’ve established that educating customers is important.

But employee literacy is even more impactful.

A well-informed staff can better serve customers and navigate challenges associated with cryptocurrency transactions.

Key Takeaways:

- Training Programs: Develop training programs to educate your team about cryptocurrencies, blockchain technology, and payment processing.

- Stay Updated: Encourage your team to stay informed on the latest developments in the cryptocurrency industry.

- Knowledge Sharing: Foster a culture of knowledge sharing within your organization.

Engaging with the Crypto Community

The documentary emphasizes the importance of community dynamics within the crypto space.

Businesses can benefit from engaging with the crypto community to nurture loyalty and support among customers who are passionate about digital currencies.

If you’d like to get started, you can check out this list on Reddit.

Key Takeaways:

- Community Participation: Join relevant crypto forums, attend conferences, and participate in online discussions.

- Partnerships: Collaborate with other businesses in the crypto realm to expand your reach and network.

- Customer Engagement: Actively engage with your customers on social media and other platforms to strengthen relationships and gather feedback.

What are your thoughts?

I am eager to hear your thoughts on this documentary.

Were you entertained?

Did you find the documentary insightful?

Most importantly, do you agree that Peter Todd could be Satoshi Nakamoto?

Please let me know in the comments below.